System Earth 1b

A planet in and out of equilibrium

Misha Velthuis

m.velthuis@uva.nl

Fri 6 Sept 2024

Recap

Link to recommendations

(Feel free to add/edit!)

Content

Systems thinking

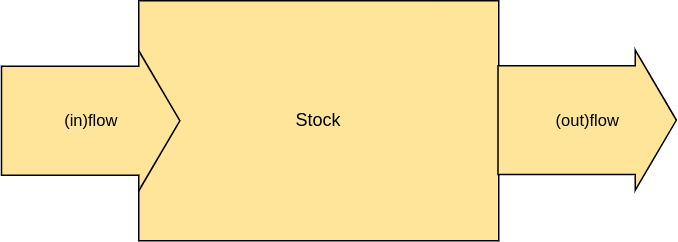

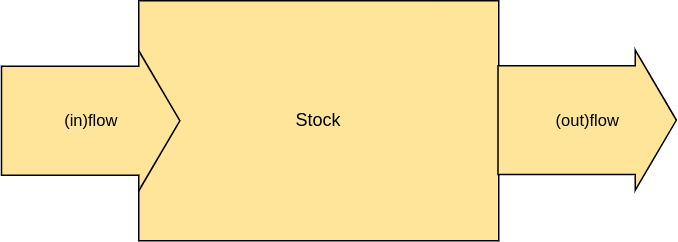

Stocks and flows

Feedback loops

Modeling dynamic equilibria (analytical and numerical)

Perturbations and forcings

Adding features: connected systems + feedback factor

Systems thinking

Tendency to focus on how things connect

Tendency to zoom out

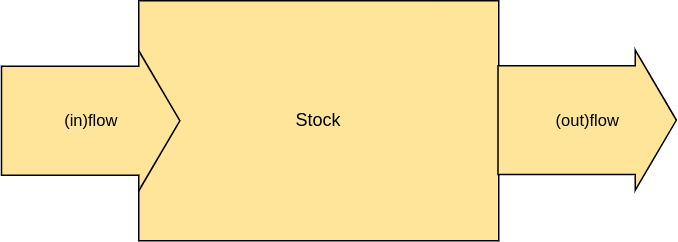

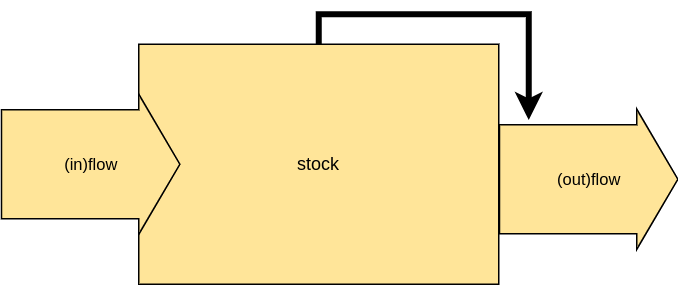

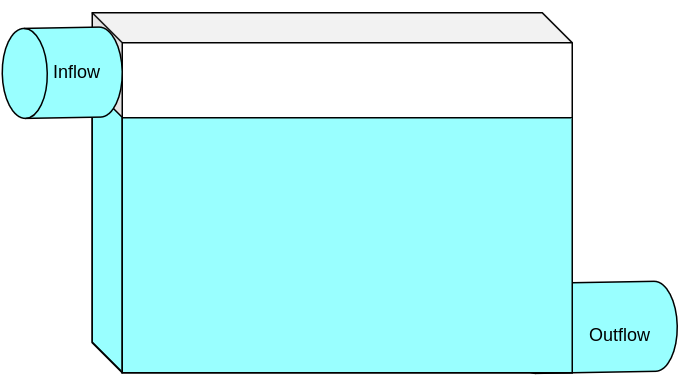

Stocks and flows

Basics

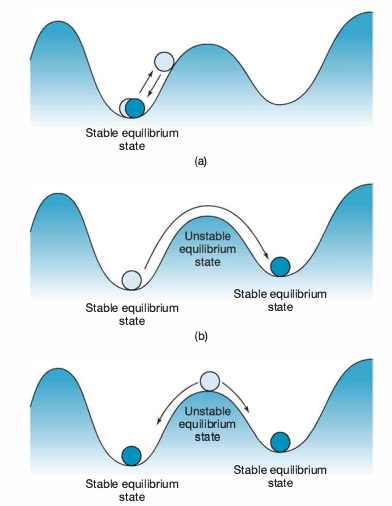

Dynamic equilibria

Average residence time

Average residence time

We are all dynamic equilibria

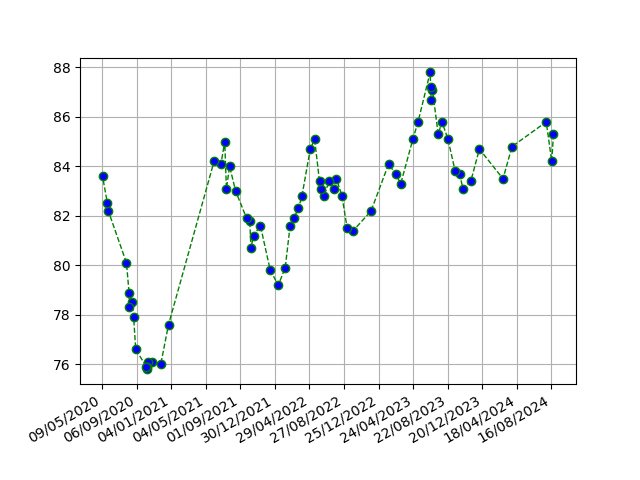

Stocks influencing flows

Me adjusting how much I eat per day

on the basis of how much I weigh

Numbers of deaths per year going up

as the population increases

Feedback loops

Positive and negative couplings

Positive feedback loop:

Change A causes change B

which strengthens change A

Negative feedback loop

Change A causes change B,

which dampens change A

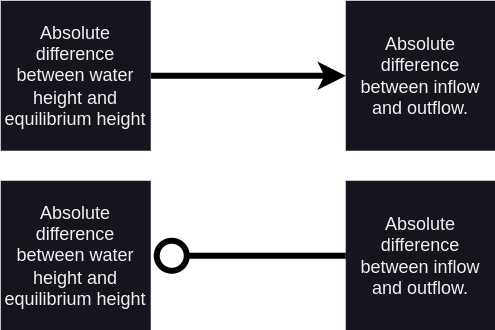

Breaking down in couplings

Positive coupling: –>

Negative coupling: –o

Combining couplings

Positive + positive = positive feedback

Positive + negative = negative feedback

Negative + negative = positive feedback

Spiral of love

happiness A –> happiness B

happiness B –> happiness A

Spiral of toxic comparison

happiness A –o happiness B

happiness B –o happiness A

Stability of a weird friendship

happiness A –> happiness B

happiness B –o happiness A

Stability of a reservoir

Stability of a reservoir

Recap of (part of) calculus

What is Euler's e?

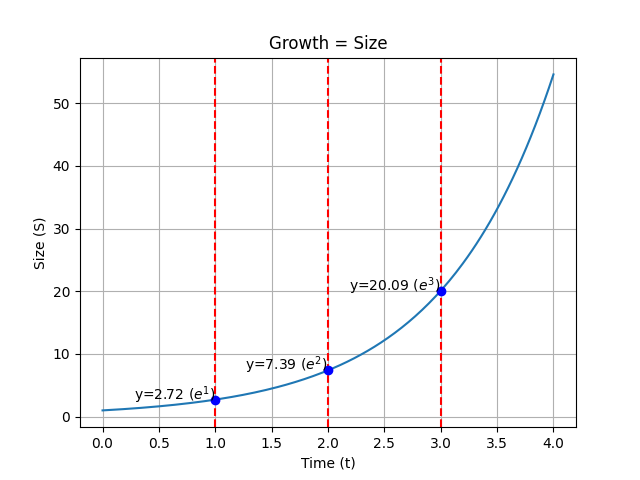

The e of Earth: growth #1

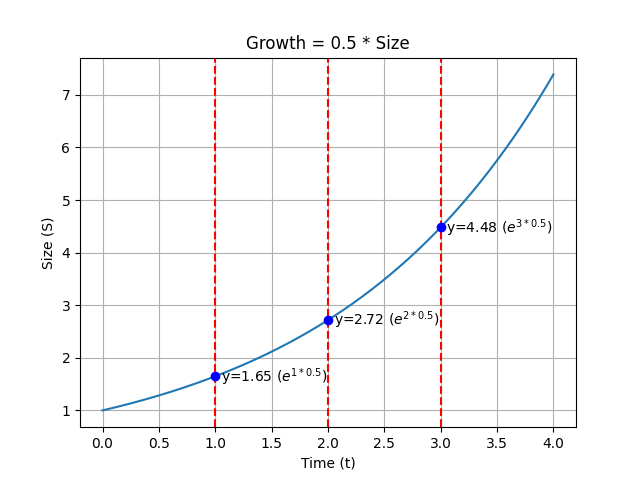

The e of Earth: growth #2

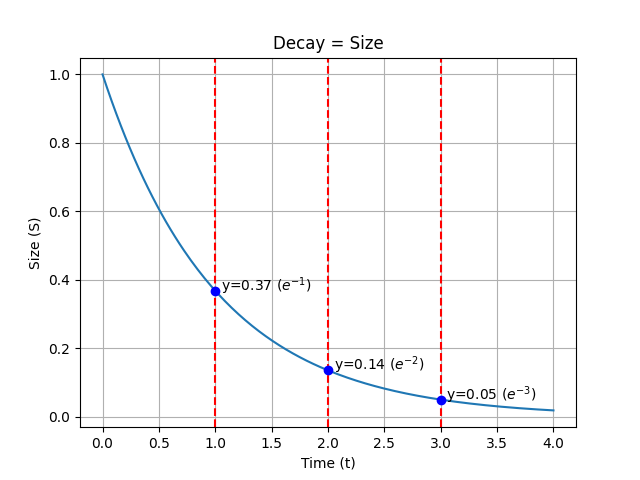

The e of Earth: decay #1

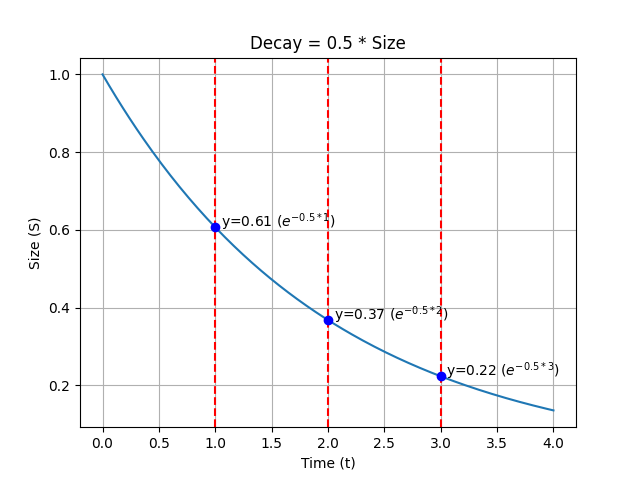

The e of Earth: decay #2

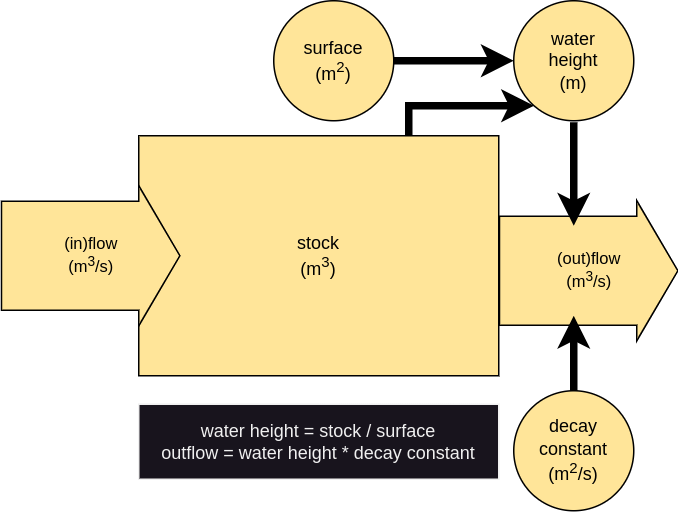

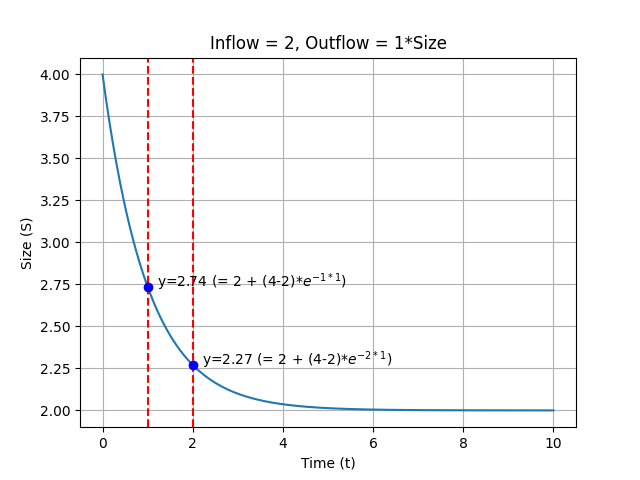

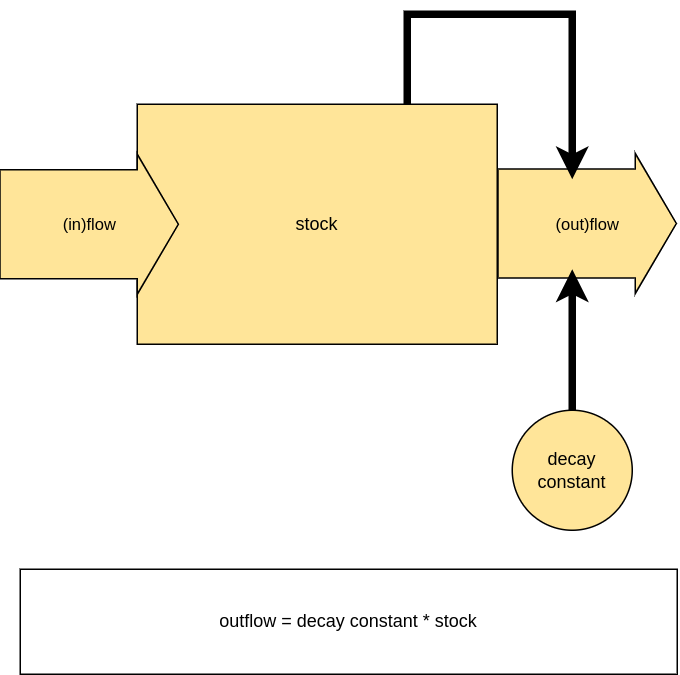

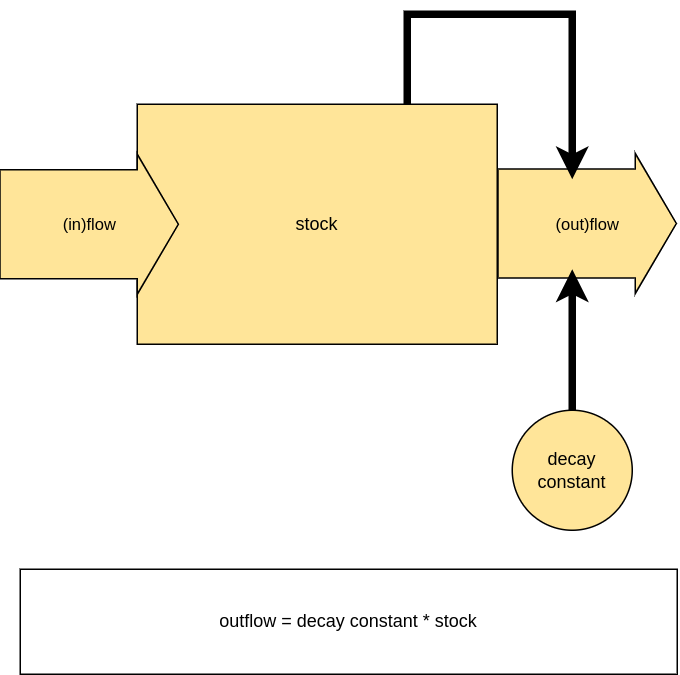

Reservoir: constant inflow, variable outflow

Numerical solutions: the easy way out

Code in Python

# Amount added every timestep

inflow = 2

# Fraction of S that flows out, every timestep

DC = 0.5

# Model runs until this time

t_end=15

# Length of each timestep

dt=1

# Create list of time

time=np.arange(0,t_end,dt)

# Create empy list for numerical series

S_store=[]

# Initialise stock size

S = 6

# For every item in the List time

for t in time:

# Calculate dS/dt

dS=inflow-DC*S

# Multiply dS/dt with dt and add to current stock size

S=S+(dS*dt)

# Append the new stock size

S_store.append(S)

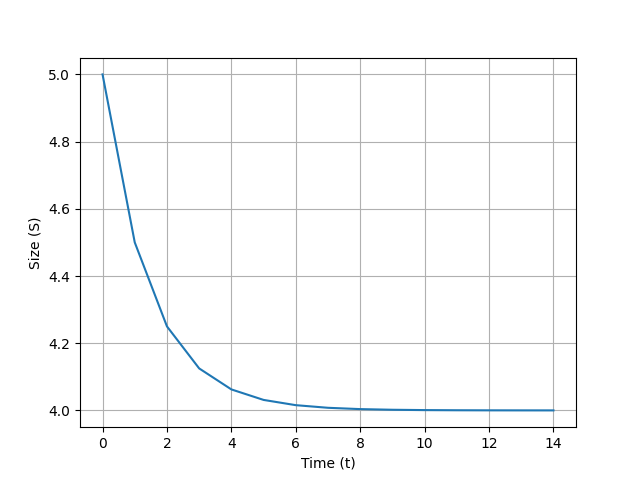

Code in Python with graph

import numpy as np

import matplotlib.pyplot as plt

# Amount added every timestep

inflow = 2

# Fraction of S that flows out, every timestep

DC = 0.5

# Model runs until this time

t_end=15

# Length of each timestep

dt=1

# Create list of time

time=np.arange(0,t_end,dt)

# Create empy list for numerical series

S_store=[]

# Initialise stock size

S = 6

# For every item in the List time

for t in time:

# Calculate dS/dt

dS=inflow-DC*S

# Multiply dS/dt with dt and add to stock size

S=S+(dS*dt)

# Append the new stock size

S_store.append(S)

# PLOTTING

plt.plot(time,S_store)

plt.xlabel('Time (t)')

plt.ylabel('Size (S)')

plt.grid(True)

plt.savefig("/home/misha/Nextcloud/mnotes/mnotes_folders/presentations/images/numerical-example.png")

plt.close()

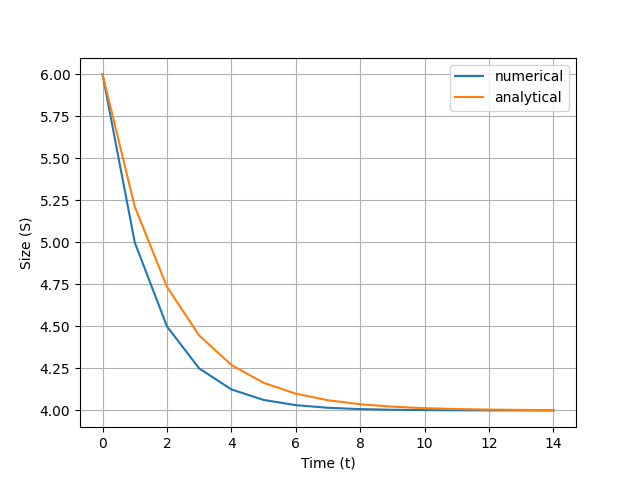

Compare numerical and analytic

import numpy as np

import matplotlib.pyplot as plt

# Amount added every timestep

inflow = 2

# Fraction of S that flows out, every timestep

DC = 0.5

# Model runs until this time

t_end=15

# Length of each timestep

dt=1

# Create list of time

time=np.arange(0,t_end,dt)

# Create empy list for numerical series

S_store=[]

# Initialise stock size

S = 6

# For every item in the List time

for t in time:

# Calculate dS/dt

dS=inflow-DC*S

# Multiply dS/dt with dt and add to stock size

S=S+(dS*dt)

# Append the new stock size

S_store.append(S)

# ANALYTICAL SOLUTION

# Determine equilibrium stock size (at which inflow = outflow)

S_eq = inflow/DC

S_init = 6

# Determine how many times the S_eq above/below the S_eq the S starts

diff_init = (S_init-S_eq)/S_eq

S2=S_eq + diff_init*S_eq*np.e**(-time*DC)

# at t=0, np.E**(0) = 1, so if factor is 1, you get Eq_S - Eq_S which is 0

# PLOTTING

plt.plot(time,S_store,label='numerical')

plt.plot(time,S2,label='analytical')

plt.xlabel('Time (t)')

plt.ylabel('Size (S)')

plt.grid(True)

plt.legend()

plt.savefig("/home/misha/Nextcloud/mnotes/mnotes_folders/presentations/images/numerical-analytic-example.png")

plt.close()

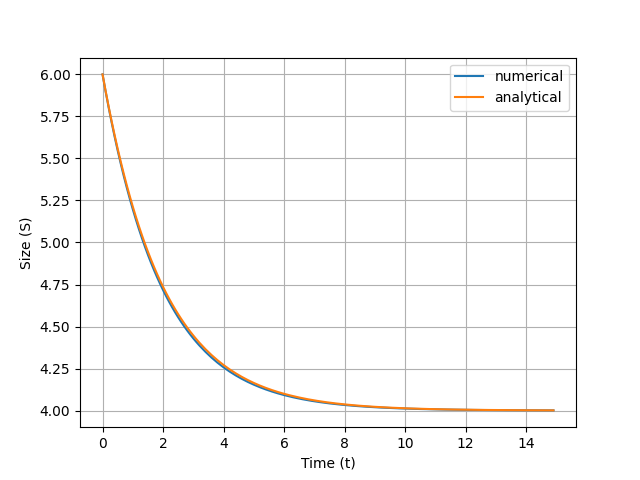

Compare numerical and analytic

import numpy as np

import matplotlib.pyplot as plt

# Amount added every timestep

inflow = 2

# Fraction of S that flows out, every timestep

DC = 0.5

# Model runs until this time

t_end=15

# Length of each timestep

dt=0.1

# Create list of time

time=np.arange(0,t_end,dt)

# Create empy list for numerical series

S_store=[]

# Initialise stock size

S = 6

# For every item in the List time

for t in time:

# Append the new stock size

S_store.append(S)

# Calculate dS/dt

dS=inflow-DC*S

# Multiply dS/dt with dt and add to stock size

S=S+(dS*dt)

# ANALYTICAL SOLUTION

# Determine equilibrium stock size (at which inflow = outflow)

S_eq = inflow/DC

S_init = 6

# Determine how many times the S_eq above/below the S_eq the S starts

diff_init = (S_init-S_eq)/S_eq

S2=S_eq + diff_init*S_eq*np.e**(-time*DC)

# at t=0, np.E**(0) = 1, so if factor is 1, you get Eq_S - Eq_S which is 0

# PLOTTING

plt.plot(time,S_store,label='numerical')

plt.plot(time,S2,label='analytical')

plt.xlabel('Time (t)')

plt.ylabel('Size (S)')

plt.grid(True)

plt.legend()

plt.savefig("/home/misha/Nextcloud/mnotes/mnotes_folders/presentations/images/numerical-analytic-example-small-dt.png")

plt.close()

smaller \(\delta{}t\)

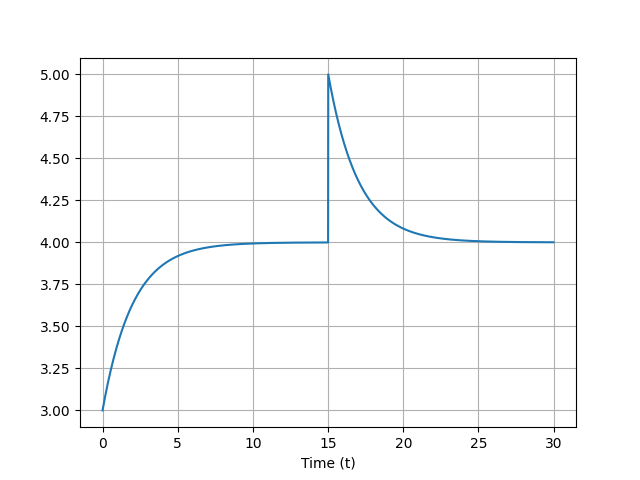

Perturbations and forcings

Perturbation

Perturbation

Forcing:

Forcing:

Response time

Let's see …

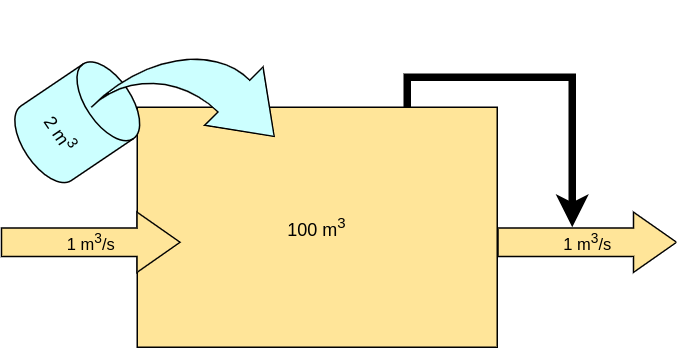

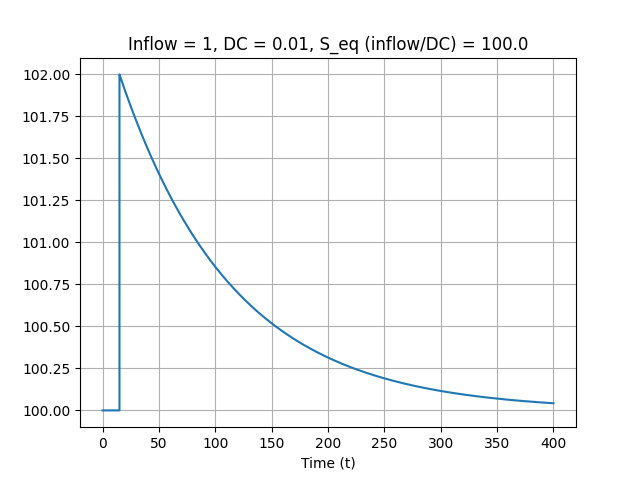

Small inflow, relative to equilibrium stock size

Small inflow, relative to equilibrium stock size

Large average residence time

Large response time

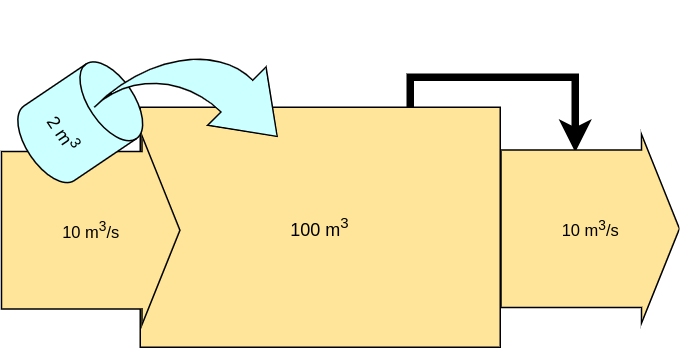

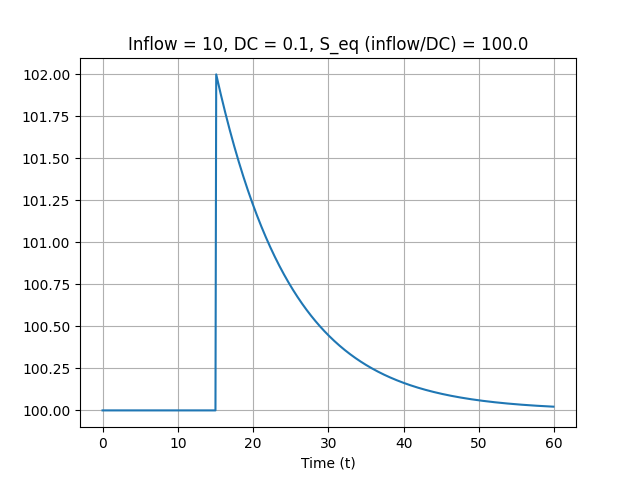

Large inflow, relative to equilibrium stock size

Large inflow, relative to equilibrium stock size

Small average residence time

Small response time

Bottom line …

Dynamic equilibria that have small flows compared to stock sizes (for example because of a small decay constant) have large average residence times, and large response times.

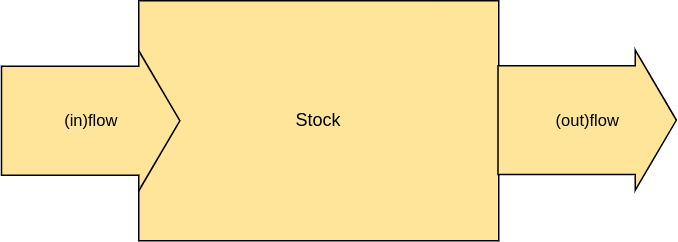

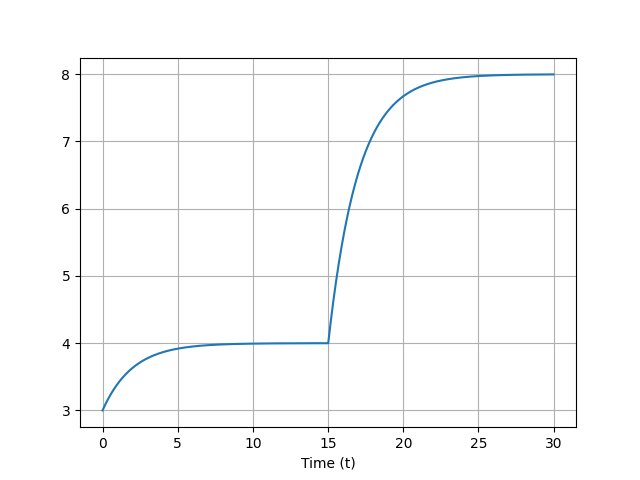

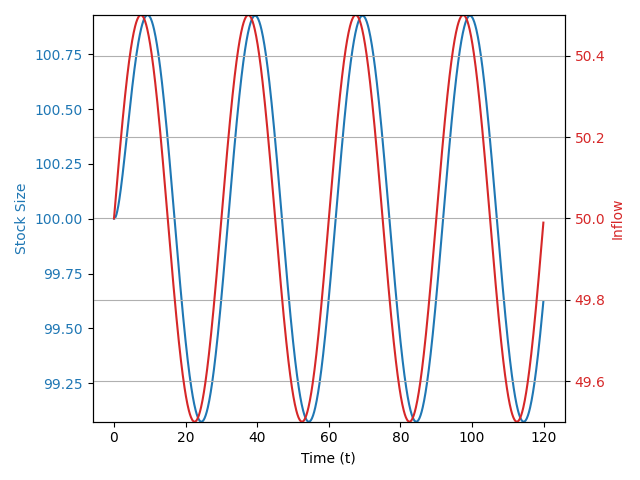

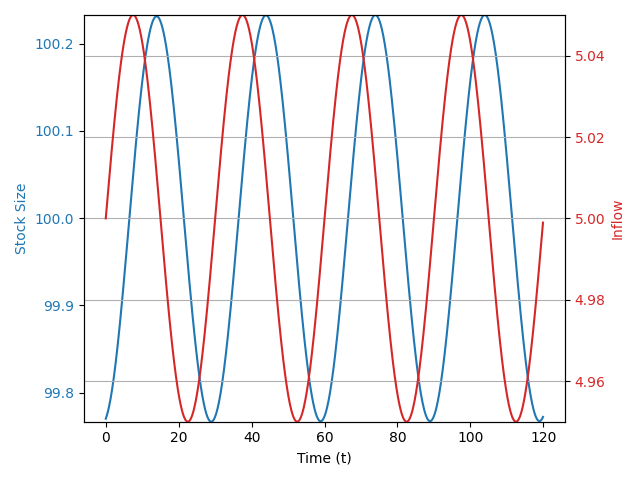

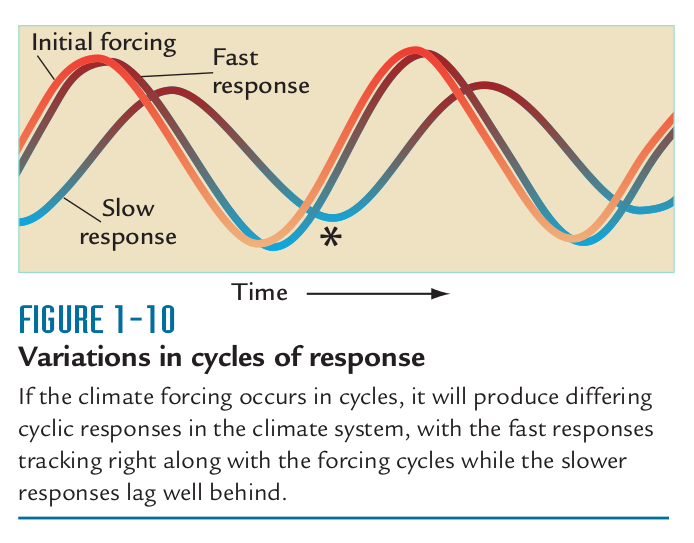

Fluctuating systems

Fluctuations with slower response time

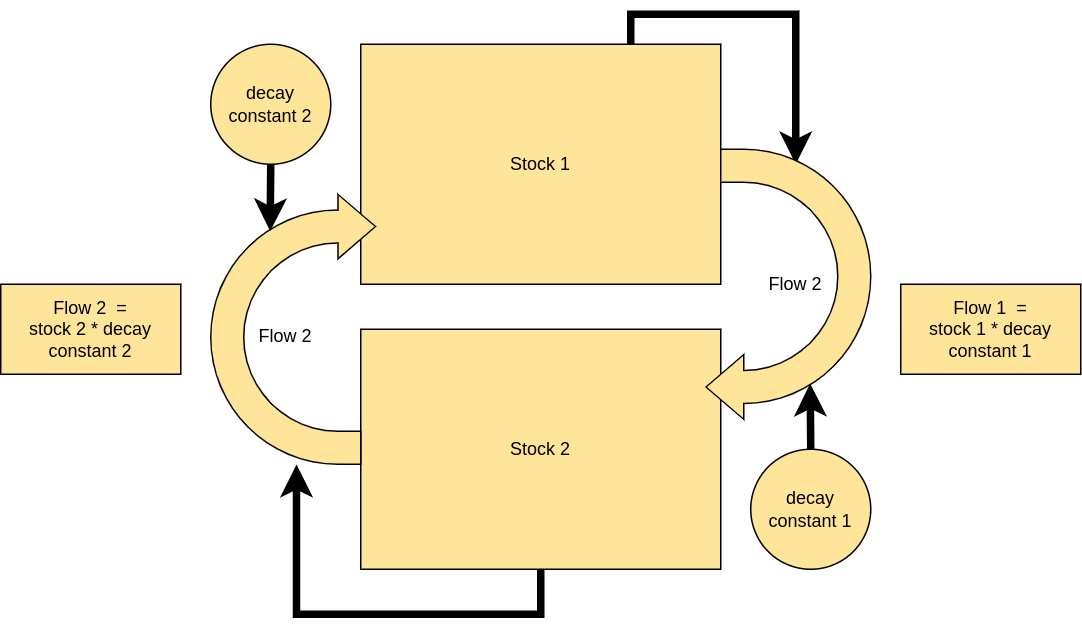

Adding features

Connected systems

Feedback factors

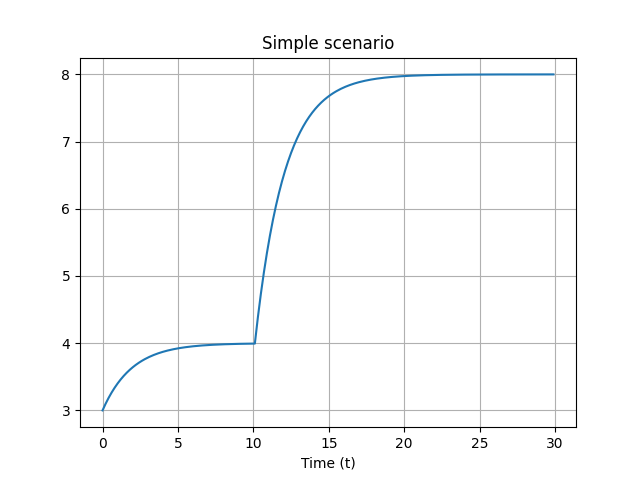

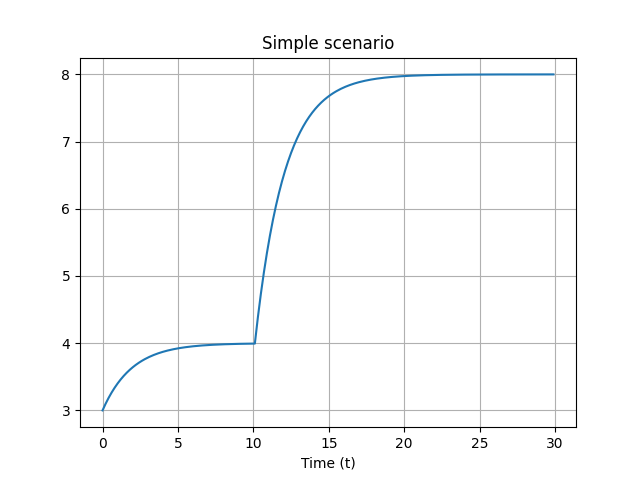

Simple dynamic equilibrium with forcing

Simple dynamic equilibrium with forcing

Simple dynamic equilibrium with forcing

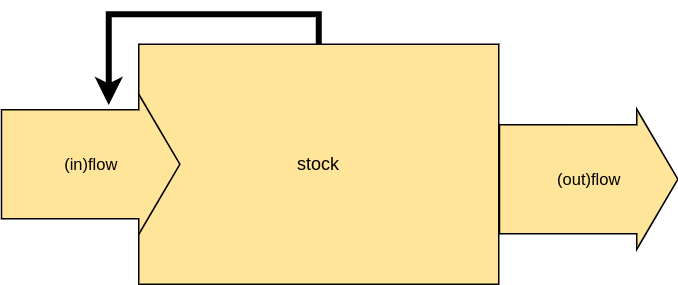

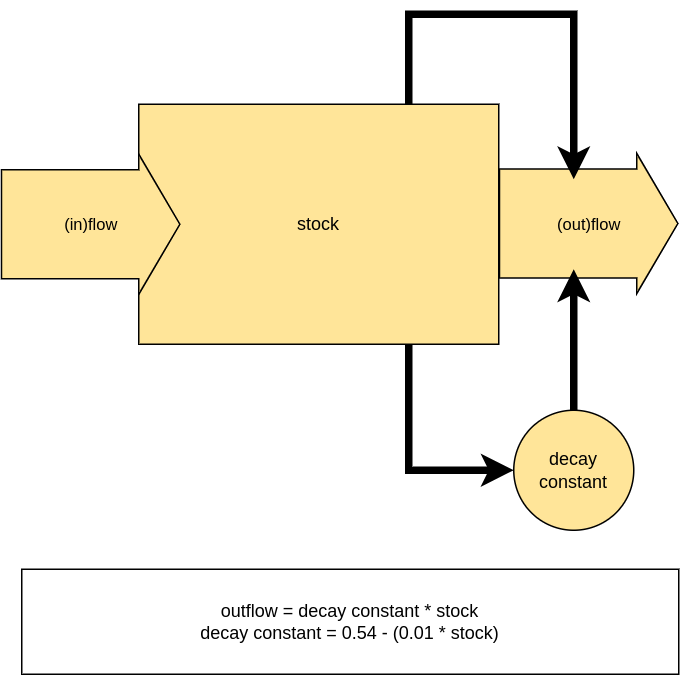

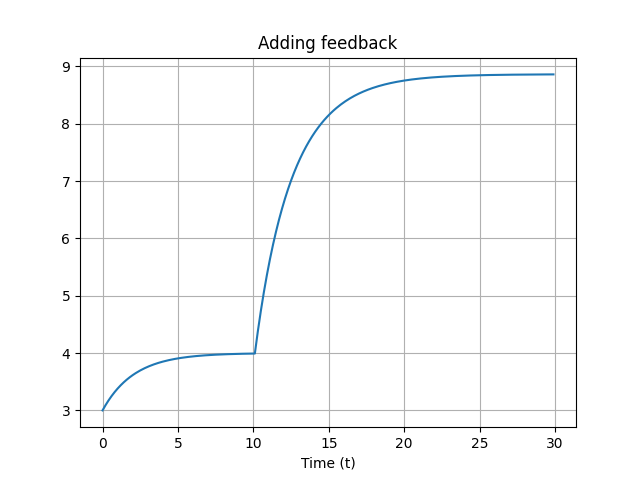

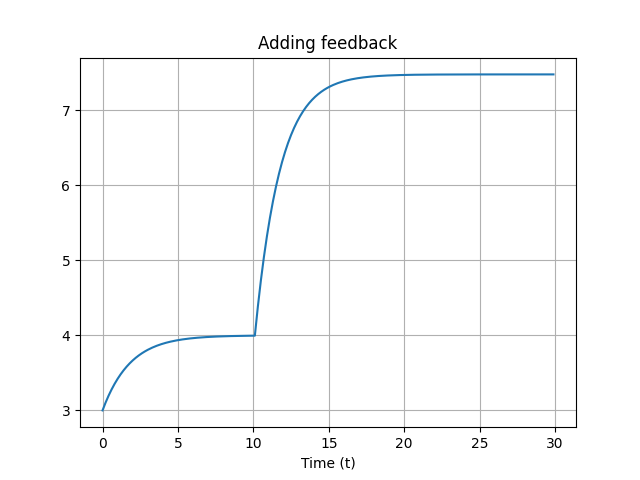

Adding feedback

Adding feedback

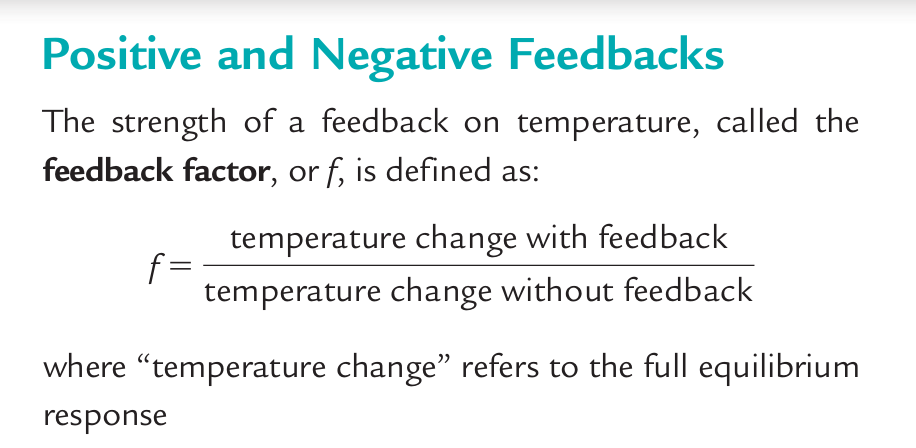

Feedback factor

Feedback factor lower than 1

Gaia hypothesis